The Reit I am talking about here is A-reit.

The annual yield include the trading gains of buying and selling and buying back again plus 1 year of dividends received.

OK, before my "regular readers" get really pissed off. A lesson learnt is really buy for sustainability of yield and not just yield.

I bought Sabana at yield of perceived 9% and was elated when they announced their Chai Chee acquisition! Wow! With growth driver through acquisition available, I am looking at 10% yield even if positive rental revision is not achieved and 1 or 2 tenancy become multi-tenanted and occupation rate slightly increase. It seems like a stock way undervalued with plenty of MOS.

In the end, you know how the story goes, the placement to fund the acquisition is at a rather hefty discount and Chai Chee is 50% occupied only (Faint!), and they only managed to renew one master lease (The smallest building).

After this saga, I look at track records, and bought into Acendas Reit, one year ago at September, It was trading at a yield of 6.5% only but I bite because I like the prudence in capital management and its predictable track records of placements (at reasonable discount) to fund acquisition and all of it are yield accretive except for 2009.

When I saw the most recent reports of Ascendas and Sabana again, it further reinforced 2 points. Buy track records than perceived good yield. You are paying your own dividend when capital loss happen when market re-rated the counter for it reduced distribution. That Sabana has so many master leases up for renewal and none with a deal yet, the probability for reduced distribution is very high. If a building is close to full occupancy, there is little reason for a master tenant not to renew its lease so close to the expiry unless it has no plans to do so. A valid counter-argument could be Sabana is bargaining very hard for a higher positive renewal rate. But if you look at management quality, pace of occupancy being filled and most importantly track records, you can easily come to a conclusion if the odds are tilt to your favor.

Now, I was having second thoughts on Ascendas due to its large size, and acquisition of 1-2 buildings will hardly make a dent to its distribution. But as luck have it, the recent market volatility allowed me to collect it again, and I am glad I did, since thereafter it made a big buy at Australia. Management has guided that it will be yield accretive and I decide to trust track records. Although there are views in forum that it is the sellers that get a better deal, I am not concerned as long as distribution improve. From what I read about the acquisition, with its blue chip tenants, and locked in positive rental renewal, chances of a nasty surprise is not high in my humble opinon (Barring unfavorable currency movement ), Best of all, they did not use placement to fund this acquisition anymore, and the odds for yield accretive purchase after cost of acquisitions quarter (1-off) is rather high.

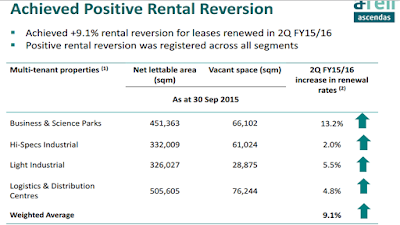

The biggest renewal rate came form business park, and the edge newspaper reported that JTC mentioned the fall in occupancy rate is greater in business park today. What good timing if you asked me, but I believed it also mean going forward we can expect little or no more such pleasant surprises.

Also, least we get carried away by the strength of improvement of distribution, take note that:

"Included in the total amount available for distribution and DPU was a one-off distribution of taxable income from operations of S$6.5 million (DPU impact of 0.271 cents) for 1H FY15/16 in relation to a rollover adjustment from prior years arising from a ruling by IRAS on the non-deductibility of certain upfront fees for certain credit facilities incurred in FY09/10. The table below illustrates the impact of the rollover adjustment on both the amount available for distribution and DPU"

That is also one -off, and if you take that off, operating results is reasonable good but nothing to shout about.

Another quality industrial reit will be Mapletree Industrial Reit with its growth from BTS and funding of acquisition thus far through cash saved from dividends reinvestment by SH. Capital commerical trust has several things going for it too, but I might not want overexposure to reits and trusts

Only problem is the high valuation above NAV will put a cap on its capital gain prospects.

OK. you can throw your eggs now ...

Hi SI,

ReplyDeleteSo does the headline help to grab more views? I've been exiting the REITS that I have and going to continue to do so when the price is right..

Hi Joyce,

ReplyDeleteSo far like no difference. In fact, it's not even close to those "popular" companies analysis posts.

I think REIT is still a good investment if the price is right ... But yes, I will divest if the price goes higher again. Just like what I did the other time.

I think interest rate impact is overblown. We should look at the underlying business as closely or even closer than interest rate

Sure. attention-grabbing headlines will attract more views.

ReplyDeleteHowever, if the content of the post is not what the readers want, it is unlikely they will fall for the same trick again.

Good call on Ascendas REIT :) On my watchlist too.

Hi dividend knight,

DeleteIf my small experince is the answer, then no, attention grabbing headlines do not increase views LOL

It's been 2 weekend days since I post. The view counts is just like my random thought series ...

A plain simple post like review of Xx company Q 2 report, if that company has many shareholders beat such post many times.

Even some of my random ramblings had much higher views ...

Do you need to increase your credit score?

ReplyDeleteDo you intend to upgrade your school grade?

Do you want to hack your cheating spouse Email, whatsapp, Facebook, instagram or any social network?

Do you need any information concerning any database.

Do you need to retrieve deleted files?

Do you need to clear your criminal records or DMV?

Do you want to remove any site or link from any blog?

you should contact this hacker, he is reliable and good at the hack jobs..

contact : cybergoldenhacker at gmail dot com