Warning: This post is for my own crystillzation of thoughts.

...............................................................

When I first start to implement D.I. (Differentiated Instructions) in my department, I only manage to plant the idea, but nothing was achieved, except willingness to look at every pupil at an individual for most of my colleagues.

I now proposed to do this.

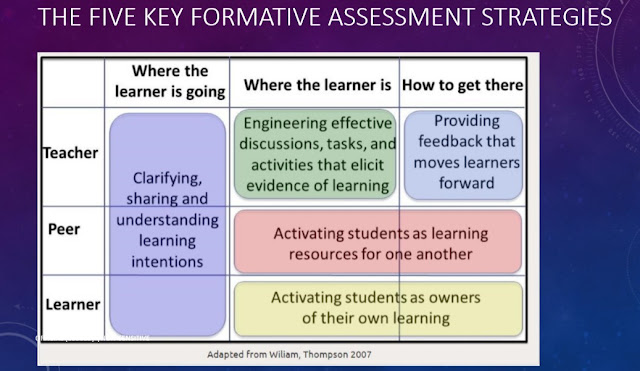

Using Carol Tomlinson D.I as the background theory behind the approach, and connecting Dylan William FA strategies as possible enabler.

A lot of schools are overly concerned with the how to, which is what the teachers "can do" to differentiate, as that is something actionable and can be easily seen, yet, that is at best showmanship, and at worst, derimental to a class learning, without looking at "according to" of the individual. Readiness is also the main bulk domain to consider, since as a teacher in Singapore, I care mainly about their results, yet, without taking into consideration the pupils' learner profile, we could be barking up the wrong tree for the intervention we wish to implement.

How do we guage a learner readiness, at the key words here is specific learning goals. So it here where Dylan William FA comes in. Again, here I caution against using piecemeal FA tool for "report writing" or showmanship. FA is a whole process for learning, and not a tool at any particular stage of learning. It needs not be restricted to a 2-3 periods lesson but be look at through the lense of mastery of a learning outcomes, breakdown and monitored by success criteria.

There is no point knowing where to go, if we don't know where the learner is, and finally, if we do not know how to get there, it is useless.

At certain point of time, there is less emphasis on where to go, or where the learner is, imagine you are taking an major exam in a week or months time, and I would say the teacher would have failed terribly if the pupils do not know where to go, and where they are, they should be slogging at how to get there. It is contextualised and if we silo out thinking, it can be detrimental to learning.

So, for the actionable part of the journey.

Where the pupil is, how do we systemically work on this.

1) ASW (Analysis of pupils' work) - To cater to readiness of pupils

2) Supplement by interview of pupils - To cater to profile of pupils (Only if ASW doesn't lead to an improvement)

By looking at the mistakes made by pupils, we can understand what are the learning gaps and propose ways to close them. Again, if we look at the Carol's framework, and a common propose solutions by teachers is "scaldfolding" and this is captured by "content differentitation". However, giving pupils peices of work with more help is actually a stop-gap measure, which need to be weds off sooner or later, and having weaker pupils ALWAYS doing easier pieces of work without intention of progress is discrimination not differentiation.

So let me proposed how we can work around the various 4 DI approach.

After ASW, there could be review of worksheets and learning materials to cater to pupils' readiness, this I believe is already done, although we seem to be looking at broad stroke of marks instead of individual pieces of work when we review our content, and the nuance improvement can be achieved in ASW of work and not just summative assessments when reviewing content.

My example:

My Pull Out class has their customized oral and writing materials that is closely aligned to the chapter taught. This is to ensure repeition of vocabulary seen, increase opportunities to use these words during reading comprehension, oral speaking and writing.

Reading passages are summarised and written in simple sentence structures, and not the same as the passages found in the textbook.

My difficulties:

There are pupils who progress through these scaldfolding and pupils who do not. On highsight, I could have used the ICT purple culture website for pupils to access the HYPY and annotation earlier, so that for pupils who have difficulties in simlified version of it, can still learn.

Although there are different tier scalffolding in the content, the pupils need to actively access the resouces and move up the tiers of support, and this is where, I find some pupils always struck at the same unrecognised words. They might have access the resources, and read and pronounciate it correctly, but still gotten it wrong when the scaldfold is removed. When these words get my individual's explanation and prompting, they still got it wrong on the third day of practice, as they could not remember it.

I believe the problem is activating learners as owners of their own learning, so that they will monitor they own mistakes and weakness. However, as motivation of the weaker pupils are low, having them do their work consistently and seriously is already a challenge, I am not sure if they are willing to monitor their own portfolio.

Also, even for pupils who have successful learnt various words through using it, it is not a quick process, and the number of words that can be constantly repeated is constrained by the theme, hence, the impact of results is low, since the decoding competency will still be quite low.

D.I Processes can be meet with Dylan 3 strategies of “How to get there"

1) Feedback (Giving individual feedback to move learning forward)

2) Activate pupils as instructional Resouces, having pupils refer to exemplar work and also others' work, to improve their work

3) Activating learners as their owners of their own learning (Self-check, error-detection, refinment of work, corrections etc)

My example and difficulties:

Right now, when a pupil could not meet expectations of a learning outcome, be it graphic stimulus, or oral recording, the teaching goes "offline" whereby I will coach them individually or in smaller groups. I have tried posting better pupils' work online, for pupils to refer to their answers, but this seem like "copying" instead of learning.

Feedback have been given to pupils, where step by step thinking process, and clearly delineated for easy teaching, and easy customization of advice to adress the particular gap. There is a routine to follow in answering Graphic stimulus interactive writing, after I realised that the question is the problem, not the graphic stimulus. The realisation happens through ASW process of 3 pupils after I seem to spot the similarity of problem for the 3 pupils who did not meet learning outcomes' expectations.

As for interview of pupils, I start to realise in Oral Conversation, and complete the conversation exercises, pupils who answer in English in their mind and then articulate their views in chinese have very horrible sentence structure. To correct the sentence structures, I need to mould their thoughts in word-phrase-sentence process during writing. Yet, oral conversation is a quick and less passive process than writing, hence, I ask pupils to visualise their answers for recount questions in Oral into a picture, and imagine that they are writing a composition. For pupils who are more of visual learners, such a step not only helped them articulate their thoughts more expressively, it also improve the content, and they seem able to elaborate on their answers better. The guess and check method for completing the conversation also worked better for some pupils whereas the translation method work for some others.

For example, the following pupils have different profiles.

Linh, Hee Jen - She is visual, when ask to recount an experince through a picture, she can do it well

Chelsa, En Qi - Need examples to repeat, tapping mainly on memory.

The rest, Justin, Urshea, ZhouJing - Need to be reminded of the various Frames

Cara and Hui En - Seem able to transfer context among writing, oral, reading passages etc best

Nikki - Seems most imaginative, can connect characters with her own stories, should perhaps work on this in her writing.

I tried using music and song to help pupils remember key points before, but it is highly embrassing. But perhaps I should try again once of these days.

Peer annotation and checks, peer check and feedback always seem to take too long and unproductive

I will stop here. Will continue next week...

How to differentiate according to content, process, product and etc

It is important here that is it very likely that for an effective DI process to takes place, there is some differentiation in at least 2 of the domains.

For example, in a reading comprehension class, if you like your pupil to do character analysis. You will need the pupils to undestand the action taken by the character, and under what circumstances the character decide on that action, and finally the impact of that action.

The internal thinking process that you would like the pupil to display will be reading, searching, and then selecting the most crucial deeds. If a pupil is weaker, instead of being able to search and select, he might need to list and eliminate.

If they have the same documents, are they able to do the same? For the weakest of all pupil, if you like to select for them, and have them decide which are the crucial deed of character, the content that the pupils received would already need to be modify.

Making connections -- By teachers --