I read an BT article on 5 investment pitfalls. I thought I blog about it to crystallize my thoughts. I hope I will be able to illustrate the various points made by the author with my own examples.

"If something is too good to be true, it probably is"

I wonder what is considered "too good to be true"? Dividends yield of more than 10%? I remember I used to own APTT, LMRT, Sabana Reit and even SPH at $3.6. Most of them have yield around 10%. except SPH.

Even suspended Qingmei gave an yield of 15% for me, once.

I think there is big difference here between trailing yield and future yield. Looking back, buying counters with trailing yield of around 10% or more usually does more harm than good to my portfolio. There are indeed years where I harvest the above 10% yield, but it is not sustainable.

LMRT issues dilutive rights (present tense is not a grammatical error), Qingmei is a fraud, APTT could not sustained the payout. I was receiving about 11% yield from APPT and lucky for me, I got out of this counter before any damage. However, I wasn't so lucky all the time, and I suffered capital loss in excess of dividends received.

I do currently own counters of yield about 10%, like Hotung, Lung Kee, MIT. They grow into it, when I first bought them, they yield 6-7%, and it is during market correction that throws out such yield, before that, the yield is even lower.

In the area of growers, I get very excited when I find a company that grows around 20-30% in both their topline and bottom line for the last 5 years, and yet trading at less than 15 times PE. I am a novice in "grower" criteria and I do not own a single Tech Stock in my portfolio. Hence, I find it hard to come up with hits and misses. I bought into CSCP believing in their pipeline of drugs (More being developed over the years), and Raffles Medical Expansion into China. I have no track records for both yet, so I will reserve judgements.

"Turnarounds seldom occur"

My investment school of thought is influenced by Peter Lynch Turnarounds and Cyclical Plays. So, trying to buy a counter when it is out of favor is indeed something I do very often.

I remembered SIA Engineering, YZJ, Sembcorp Industries, QAF, Singtel, SingPost, Golden Agri and SPH, Pan United are all purchases based on cyclical upturn analysis.

I have both hits and misses.

Those that faced disruptive forces are counters didn't turn out well. SingPost, new growth area is e-commerce and SPH's property, both companies did not fare well. Both counters are in the red. I deliberately left out Sembmarine but bought into SCI. Nonetheless, I believed SCI will turnaround together with SCM. It is with a stroke of luck that SCM is demerged. I am betting actually on SCI doing infrastructure trusts like Keppel, but it turns out better than I expected. When they are demerged, I sold SCM.

The lesson here is clear, it is difficult to turn ship with a heavy load (baggage). It is easier for companies to outlast an oversupply situation or unfavorable market conditions, than overcome structural disruption. For example, with ESG becoming a corporate culture in boardrooms, I think fossil industry will likely face structural decline in the future. I think I will swear off fossils plays. (Although I did own SInopec, but China is a different story)

The next lesson here is management's alignment to shareholders' interest. LMRT is frequently doing highly dilutive rights and buying assets of questionable quality. Sabana bought a 50% occupied high tech building and has problem filling it up. and management Incompetence aggravated the problem. First Reit has the same owner as LMRT, and they also did a dilutive rights issue, but I see management competence the biggest difference between FR and LMRT. Sabana seem to be faring better now after Kelvin, its ex-CEO left.

QAF has a suffering pork business in Australia, Rivea (I hope I get the name right), it dragged the earnings down. I bought it as I believed that is a cyclical business and the high cost of feeds is due to weather factors that might not be recurring. True enough, the business did better, again (It is not the first time it happens, QAF has been trying to sell the poultry business twice without success). QAF is one of my better performing counter in SGX yielding 7% with capital gains.

Another factor to look at is profitability in the face of downturn. Yes, profits will fall, but keeping company profitability means the chance of permanent capital loss is low. YZJ is the star that comes to mind, having navigating the downturn well with its sideline of HTM business. It is not easy to get a good yield from YZJ and it is difficult to quantified the risk of it HTM business. Nonetheless, I believed these are accounted for in it valuation in terms of PB as compared to industry peers.

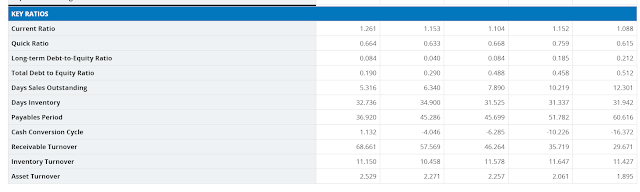

Source: DBS research

I also fare better with companies with information on industrial indicators aplenty. For example, in the analysis of Pan United, the price of RMC and construction demand figures are easily available in URA website, this makes modeling of earnings possible. And in the case of YZJ, freight rates, bulk rates, newbuild numbers, are also easily available in numerous websites. Even with these information, I am mindful it is still very much a guessing game. So I practiced diversification in investing.

So how do we know if a company competitive strength is intact. In the case of APTT, the last 8 quarters show a consistent fall in basic cable TV subscribers and while premium digital TV subscribers are increasing, the ARPU is falling. It shows a lack of pricing power with the industry. The broadband segment is touted by analysts as a growth area due to 5G rollout. However, ARPU is also falling and the EBITA is not growing. Taiwan at the verge of a possible lockdown, and I assume its premium TV might be do very well in such circumstances, but after looking at it numbers, it did not instill confidence.

Hence, I believe the better days of turnaround are far from near, although it is worth monitoring.

Selling a winner too early

Well, Venture comes to mind. What would have been a possibly 3 baggers became a 30% gain. For context, I bought Venture at average price of $8, and sold it off at $11

I have also seen Lee metals (Now bought over and merged with BRC Asia) 50% gains evaporated in front of my very own eyes when I didn't sell.

Lee metals earnings get a bump up due to its opportunistic and profitable EC venture. Given that is is non-recurring, I should have sold when the earnings improved as I expected it. The catalyst is non-recurring and I could not understand why I not sell then.

Cogent, which is privatized by Cosco, is another example. It is another 3 baggers. I didn't believe the rumors of an offer. I bought it at 28 cents, and the offer came 2 years later, iirc at 80 cents.

I think if the operating numbers did not deteriorate too much, it might be wise not to sell too early, unless it is OVER-valued compared to fairly valued. Since if the competitive strength is intact, it should continue to grow or recovers from the down cycle.

I am consistently tempted to sell some of profitable counters, but I now reminded myself to sell only if operating numbers show loss of competitive edge over a few quarters.

Buying into false promises

Silverlake Axis comes to mind. Granted, the false promises comes from both management and the delusional myself. I correctly predicted an upturn of earnings as the big projects scored by company seem to be underappreciate by the public and how usually IT system get obsolete after 4- 5 years. I predicted and upturn should come sooner than later. correctly in 2019.

I did make some good money earlier on, buying at 40 cents and selling at 55 cents. But I bought more than I sold, and I average down at 30cent at 24 cents. My thoughts is business will improve after Malaysia MCO is over, and the big projects win will continue. Yet, it is long wait without improvement

I am actually willing to wait it out, given that no one could predicted COVID-19. The red flag is the suspension of dividends. The used to give out dividends in 3 quarters, and while they promised during AGM Q and A that they understand dividends payout is important to investors, they skip an quarter of dividends and blame it Half-Yearly reporting. When is 1H reporting, they have the cheek to skip it again and declare that they will only give year end dividend.

So, I said "GoodBye" to the counter. Doesn't matter if they do better again. if I cannot understand a management or trust it to be aligned to shareholders, then it is a sell.

Conclusion

If you have reading until here. Thank you. My mind is slightly clearer, I hope you are not too confused. I welcome your thoughts.