To cut the story short, I will like to share how I have applied my own future modeling using Singapore Companies as case studies. Readers who are interested, please read the book, as I am just trying to scratch the surface with my explanation.

First Step: Look for Market leader.

The reason is simple. I want a company that can captured the industry upturn. A company that will gain when industry turn around and not continue to be a laggard.

The example, I am using is PAN United. Looking at Revenue.

Pan United Rev from Cement and Construction materials

2018: 545,710,000

2017: 527,674,000

2016: 577,639,000

2015: 668,421,000

You can see from here there is some sort of correlation and according to https://brandongaille.com/18-singapore-cement-industry-statistics-and-trends/

PAn united is the biggest Cement supplier. Engro, another Cement Supplier listed Singapore managed

2018: 153 mio

2017: 141 mio

2016: 144 mio

So I think there is no doubt Pan United is a Key Market Player that will stand to gain when industry upturn happen.

Second Step: Check for correlation

Profits from the segment of construction material

2018: 8,496,000 with rev 545,710,000

2017: 8,958,000 with rev 527,674,000

2016: 10,657,000 with rev 577,639,000

2015: 12,859,000 with rev 668,421,000

2014: 24,219,000 with rev 612,097,000

2013: 39,406,000 with rev 599,049,000

You can see margin destroyed due to lower demand as well as competition. But Pan United has hold market share reasonable well.

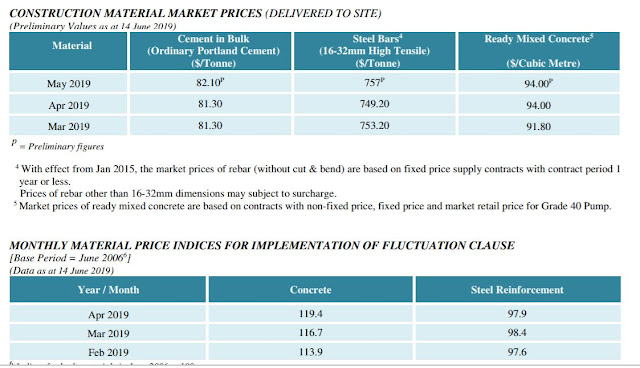

One more chart.

You can see the "good times" correlate to good price of cement RMC.

I am aware of different grade of RMC, the one included in BCA statistic is Grade 40, and there are different type of Concrete, some quick solidifying, some green and carbon neutral, but I still think is a reasonable calculated guess.

So is 2016 - 2018 horrible years in construction demand? From BCA data, the demand for construction in those three years are:

(Data from BCA)

2018 - 27 bio

2017 - 24.5 bio

2016 - 26.1 bio

2015 - 27.2 bio

2014 - 37 bio

Again, it seem 2014 is the golden year for a good reason.

BCA projection of demand is always announced in January. In January the projection is

Third: Guess Industry upturn

It seem it is going to be a slow year yet again, but the 9 bio expansion by MBS and Genting are announced in April, and I am quite sure assuming 3 Bio A year over the next 2 years when construction start, this demand is not captured in the projection, at least not accounted for in the lower end of projection

Worst case scenario, up to April, it is on track to hit the lowest 27 Bio Demand, so it should not get any worse. Reading on Pan United Quarter reports and BCA announcement of big tenders, various En-Bloc redevelopment again seem un-captured in 2018.

RMC price is better in Q2 than in Q1, and Pan United Q1 results is already better in 2019, than 2018. I assume that the worst is over for Pan United.

In the book, the author model precise earnings.

I will pass giving a giving an exact figure, I will instead guess a range of possible earnings. Assuming if price of RMC return to the good old days of 110 and above, will margin be closer to the bountiful of years of above 5% ( >6% in 2014)?

2018 margin is at 1.5%, it does not need a party for margin to double. Assume Status Rev 550 mio in 2019 and 600 mio in 2020 (Where the demand for the IR should start flowing), and Margin of 1.8% in 2019 and 2% in 2020, we should see profits of 9.9 mio and 12 mio.

Even if margin double, the best case and most optimistic scenario, it is still only half of what it is like in the good old years. So for a conservative projection, we see EPS of about 1.4 cents, 1.66 cents in 2020.

Assuming pay out ration of 80%, dividend will 1.12 cents and 1.32 cents.

So at current price, PE for 2019 can be 24 times or at good as 12 times (If margin improve to 3%)

Yield can be 3% or 6%

So at current price, it makes no sense for me to add, no matter how much I like it. I bought my first tranche of Pan United at 28.5 cents, so valuation use, it makes slighly more sense at future PE of 20 times or 10 times, and dividend of near 4% to 8%

As I mention earlier, I did a range of valuation than giving a fix figure, but if second quarter earnings makes 1H earning out of my expected range of earning, I know it is time to say good bye.

.................................................................................................................................................

This is the first time, I spent so much time writing an article on investment, I will leave QAF modeling to next time. (Not vested in QAF)

First, I want to complement this site administrator for creating this platform I frequently get cold sores(which lasts for 5-6 days on my lips and its painful both physically and mentally) .. As a bodybuilder, I basically get outbreak due to the daily pressure and heat in the body.. Recently I stumbled upon my salvation. I found a herbal remedy to cure hsv completely, in just 4weeks ..

ReplyDeleteI got to know about Dr Utu after seeing a lady's testimony online. I reached the doctor and I ordered for herpes herbal medicine. He sent the herbs to me and I started making use of them. In just 2days, the cold sores are cleared. 4weeks after medication, I went to the hospital for test of cold sores and it was completely NEGATIVE.

By following every prescription, i was able to cure my cold sore in less than 4weeks. 100% natural herbs no after effect.

Note: Please do let others know if this work for you.

The doctor's email is drutuherbalcure@gmail.com

Note : follow all instructions accordingly..

If you are sure that you have benefited from this African herbs be courageous to inform others.

Thanks in advance

Do you need to increase your credit score?

ReplyDeleteDo you intend to upgrade your school grade?

Do you want to hack your cheating spouse Email, whatsapp, Facebook, instagram or any social network?

Do you need any information concerning any database.

Do you need to retrieve deleted files?

Do you need to clear your criminal records or DMV?

Do you want to remove any site or link from any blog?

you should contact this hacker, he is reliable and good at the hack jobs..

contact : cybergoldenhacker at gmail dot com